Protection from

Risks in Retirement

SecureStage Supplemental Benefits EndorsementSM

This 3-in-1 benefit endorsement is included on Secure Horizon IUL policies for no additional premium and can offer you more financial comfort through life’s stages. These benefits can help provide protection against common risks in retirement.

Helpful resource

Marketing materials may not be available for use in all states.

Industry-first Longevity Benefit Base

The SecureStage Supplemental Benefits Endorsement is powered by the Longevity Benefit Base, referred to as the Benefit Base in the policy, that is adjusted by 150% of credited interest1 and can be used for any of the three available benefits. The hypothetical example below shows how the Policy Value grew by $300,000, while the Longevity Benefit Base grew by $450,000.

The hypothetical example shows how the Longevity Benefit Base is designed to be adjusted by one and a half times the credited interest1 (assuming no partial withdrawals and no election of an accelerated death benefit). The Longevity Benefit Base cannot be withdrawn as a lump sum and is not used for calculating the account value or surrender value of the policy. Hypothetical examples are for illustrative and educational purposes only and not intended to predict future performance.

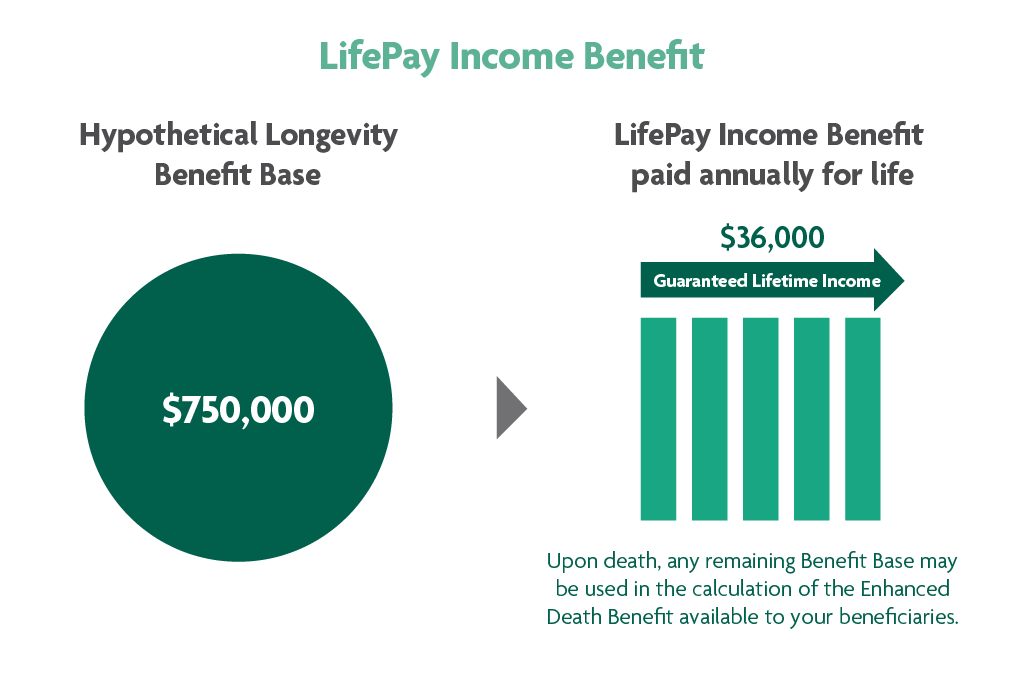

Guaranteed Lifetime Income

The LifePay Income Benefit can provide a source of guaranteed lifetime income, to age 100 or more. The hypothetical example below shows how a Longevity Benefit Base of $750,000 could provide $36,000 in annual income (paid monthly) for life.

The LifePay Income Benefit is a lifetime payment based on the Longevity Benefit Base at the time of election. This is a hypothetical example and provided for illustrative purposes. Actual lifetime income payments would be calculated based on the Longevity Benefit Base at election multiplied by an age factor. The LifePay Income Benefit is paid monthly. You are not required to take the full income amount. The LifePay Income Benefit and PlanGap® Benefit can be taken at any time but cannot be used simultaneously. One benefit must be stopped before starting the other benefit.

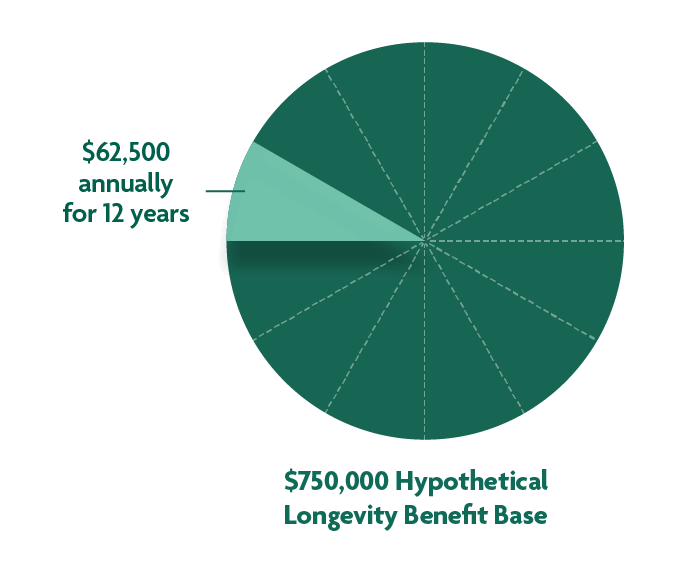

PlanGap® Benefit

The PlanGap® Benefit can help offset potential reductions if Social Security benefits are reduced due to a government mandated change of more than 3%.3 The hypothetical example here shows how a Longevity Benefit Base of $750,000 could provide equal monthly payments over 12 years totaling $62,500 annually.

This is a hypothetical example assuming the Longevity Benefit Base is equal to $750,000 at the time of electing the PlanGap® Benefit. The PlanGap® Benefit is paid monthly. It is important to note that a reduction in benefits is only one possible outcome. A few additional options could include increasing taxes, raising the future retirement age or even implementing a means-test that would reduce benefits for high earners. The LifePay Income Benefit and PlanGap® Benefit can be taken at any time but cannot be used simultaneously. One benefit must be stopped before starting the other benefit.

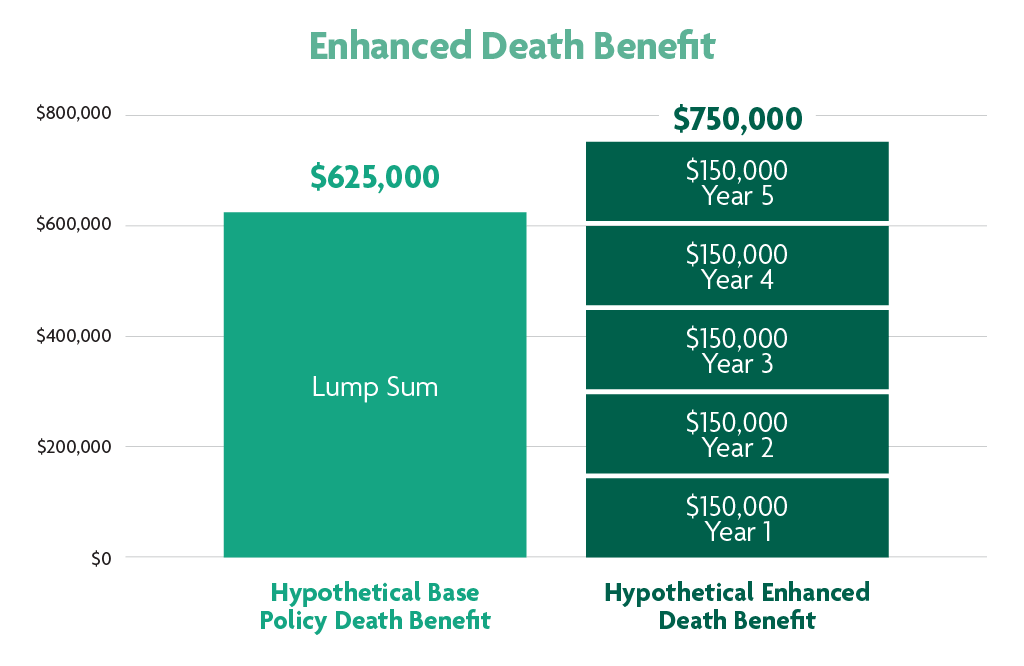

Leave a Greater Legacy

With the Enhanced Death Benefit, you have the opportunity to leave a legacy that may be greater than your base policy death benefit. The hypothetical example below shows how the base policy death benefit of $625,000 could be taken as a lump sum or the Enhanced Death Benefit of $750,000 paid out in equal annual payments over five years. The Enhanced Death Benefit will not be greater than 120% of the base policy death benefit and is available after year two.

This is a hypothetical example assuming the Longevity Benefit Base is equal to $750,000 and the Hypothetical Base Policy Death Benefit is equal to $625,000 at the time of the Death Benefit payment. Only one Death Benefit will be paid. This hypothetical example does not represent an actual product. This example is for representative purposes only. Any outstanding policy debt at time of death is subtracted from the Longevity Benefit Base. The Enhanced Death Benefit is available even if the LifePay Income Benefit and/or PlanGap® Benefit have been taken.

Additional riders and endorsements

Accelerated Death Benefit Endorsement

Accelerated death benefits allow you to access a portion of the death benefit when diagnosed with a qualifying critical, chronic, or terminal illness. There’s no additional premium required. However, there is an administrative fee at the time the chronic or terminal illness accelerated benefit is elected. The accelerated amount of death benefit will be discounted and the amount received will be less than the amount of death benefit accelerated. A prorated amount of the accelerated amount will be applied to policy debt. These benefits are subject to eligibility requirements.

Overloan Protection Benefit Endorsement

The overloan protection benefit will keep the policy from lapsing due to excessive loans and continue to provide death benefit coverage. If elected, the guarantee provided by this benefit may help you avoid the adverse tax consequences that can result from a policy lapsing due to excessive loans or withdrawals.4

Protected Death Benefit Endorsement5

The protected death benefit can be an excellent option for those who will use their policy to help supplement their income but also desire the guarantee of a specific death benefit amount upon their death. In some cases, you may determine that you do not require the level of death benefit coverage as originally issued on the policy. The guarantee provided allows you to choose your minimum death benefit amount, while you continue to access your accumulated policy values through loans or withdrawals.

1 Credited interest is any Index Credit and interest credit minus Index Credit and interest credit attributed to Interest Bonus on Fixed Interest Participating Loans.

2 Source: The 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds.

3 The PlanGap® Benefit is known as the Income Gap Benefit in the policy. The PlanGap® Benefit is not a replacement for social security benefits but provides a benefit designed to mitigate a reduction. For purposes of this Endorsement, reduction means a reduction in social security benefits due to a change implemented by the Social Security Administration or other federal law or regulation. It does not include reductions in your social security benefits based upon your actions (including any elections under social security or changes to your social security elections) or change in circumstances. Limited to the insured’s policy age being between age 62 and 85 and waiting period of 10 years for issue ages 0-59, and 5 years for issue ages 60+. If the Insured passes away while receiving the PlanGap Benefit, the payments will cease.

4 In some situations loans and withdrawals may be subject to federal taxes. Neither North American Company nor its agents give tax or legal advice. Customers should be instructed to consult with and rely on their own tax advisor or attorney for advice on their specific situation. Income and growth on accumulated cash values is generally taxable only upon withdrawal. Adverse tax consequences may result if withdrawals exceed premiums paid into the policy. Withdrawals or surrenders made during a Surrender Charge period will be subject to surrender charges and may reduce the ultimate death benefit and cash value. Surrender charges vary by product, issue age, sex, underwriting class, and policy year.

5 The Protected Death Benefit cannot be elected if the Over loan Protection Benefit is in effect.

Indexed universal life products are not an investment in the “market” or in the applicable index and are subject to all policy fees and charges normally associated with most universal life insurance.

North American Company for Life and Health Insurance is not affiliated with the Social Security Administration (SSA). North American’s product(s) are not sponsored, endorsed, sold or promoted by the Social Security Administration, and they make no representation regarding the advisability of purchasing of the product(s).

Life insurance policies have terms under which the policy may be continued in effect or discontinued. Permanent life insurance requires monthly deductions to pay the policy’s charges and expenses, some of which will increase as the insured gets older. These deductions may reduce the cash value of the policy. Current cost of insurance rates and current interest rates are not guaranteed. Therefore, the planned periodic premium may not be sufficient to carry the contract to maturity. For costs and complete details, call or write North American Company for Life and Health Insurance, Administrative Office, One Sammons Plaza, Sioux Falls, SD 57193. Telephone: 877-872-0757.

The term financial professional is not intended to imply engagement in an advisory business in which compensation is not related to sales. Financial professionals that are insurance licensed will be paid a commission on the sale of an insurance product.

Annexus and their affiliated agencies are independently contracted with North American Company for Life and Health Insurance.

Secure Horizon IUL is issued on form P100/ICC22P100/P100CA(policy), E100/ICC22E100, E101/ICC22E101, E103/ICC22E103, E104/ICC22E104, E105/ICC22E105, E109/ICC22E109, LR498, E110/ICC22E110/ LR50704, E111/ICC22E111/LR50604, E113/ICC24E113, E114/ ICC24E114, R100/ICC23R100, R101/ICC23R101, R102/ICC23R102, R103/ICC22R103, R106/ICC23R106, (riders/endorsements) or appropriate state variation by North American Company for Life and Health Insurance®, West Des Moines, IA. Products, features, endorsements, riders or issue ages may not be available in all states. Limitations or restrictions may apply.

Sammons Financial® is the marketing name for Sammons® Financial Group, Inc.’s member companies, including North American Company for Life and Health Insurance®. Annuities and life insurance are issued by, and product guarantees are solely the responsibility of, North American Company for Life and Health Insurance.

1822NW-22

07/25

Offset Potential Social Security Reductions

By 2033, the Social Security Retirement Trust Fund is projected to become depleted with 79% of benefits payable at that time.2 As one of the largest retirement assets for most Americans, a potential benefit reduction could mean a loss of hundreds of thousands of dollars over a retiree’s lifetime. The chart below shows examples of household social security benefits and what a projected 21% reduction could mean both monthly and over your lifetime.

Assumptions: Receiving social security benefits from age 67 through age 90 with a 21% lifetime reduction and a 2.4% Cost of Living Adjustment (COLA). Hypothetical examples and illustrations are for illustrative and educational purposes only and not intended to predict future performance. The use of alternate assumptions could produce significantly different results.